Starting out investing can be hard to get your head around, all investors have been through it. Follow these 5 simple steps to start your investing journey…

1. Save an Emergency Fund

An emergency fund should ideally cover 3 – 6 months of living expenses. This amount will differ for everybody, depending on your circumstances such as those with mortgage payments and dependents to look after.

This money will need to be accessed easily and straight away in case of an emergency such as if you lose your job, sudden repairs are required or bills need to be paid suddenly.

Good places to save your emergency fund include high interest saving accounts, current accounts or Premium Bonds. Make sure that the account is easily accessible if and when the money is required and if it is ideally beating inflation.

2. Be in Control of your Debt

The debate is ongoing on whether or not to invest whilst you hold debt. This really does depend on your situation – remember personal finance is personal for a reason, everyone has different ways they want to manage debt and investing. Factors such as interest being charged on debt, your risk tolerance and your own outlook on the debt will all play a part in balancing both.

If you are interested in paying of your debt, the two main debt paying off methods are:

- Snowball Method – pay off the smallest amount of debt first before moving onto larger debt totals.

- Avalanche Method – make the minimum debt payments. Pay off debt with the highest interests with any left over money.

Be SMART with your debt and investing goals, ask yourself if you can balance debt payments and fund your investing.

3. Fund your Investing

How will you fund your investments? Could you start earning additional income to support your investing?

A good way to do this is to create a budget if you have not already and add a section for ‘investing’. This will ensure that you can put aside some money every month to put towards investing. Another option is to track your expenditure. This will help you to identify exactly where your money goes and areas where you could potentially cut back on spending. Are there any areas you could cut back on – such as too many trips to restaurants, this money could potentially be doing better if invested.

To start investing you really do not need a lot of money, unlike what is commonly thought. Many investing platforms allow you to invest with at least £2! Even putting aside and investing £50 a month will result in benefits in the future.

4. Find an Investment Platform

From Hargreaves Lansdown, AJ Bell, HSBC, MoneyBox, FreeTrade and Trading212, just to name a few…there are a ton of investment platforms – which can be incredibly daunting. Therefore this step is important in order to ensure that you are investing on a platform that aligns with your needs. Platforms range from DIY (you select the individual investments) to robo-investing (the platform will select what funds your money will go into. Check out my Freetrade review or follow my Nutmeg referral if you are interested in using a robo-investing platform.

Due to the vast amount of platforms available, do not go for the first platform that appears on your search – make sure you have a clear idea of what the platform will provide for you and if it will meet your needs.

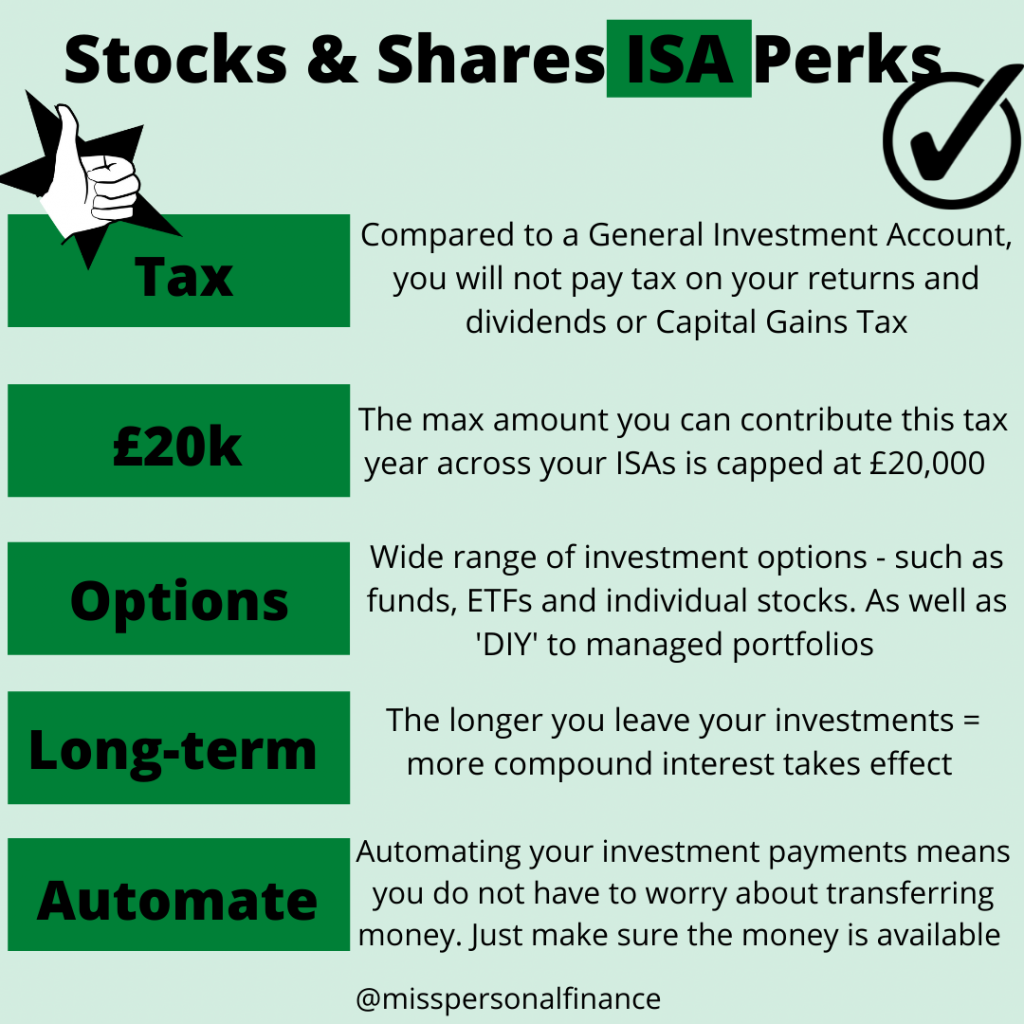

ISA

If you a UK based investor – make use of your government provided ISA.

ISA stands for Individual Savings Account and is an allowance of money that will not be taxed when used, as of the current tax year the ISA limit is £20,000 . Whilst the majority of investing platforms now offer Stocks and Shares ISAs, make sure your chosen one does if you are interested in investing within an ISA.

5. Research

This will be a continuous process as you find out where exactly to invest your money (such as ETFs, index funds or single stocks). Before investing your money anywhere it is crucial you understand where your money is going and the risks involved with investing.

Understand your risk threshold before starting to invest, usually your age determines how risky your investments should be. Generally, as you grow older your investment portfolio should move to less risky assets.

It is also a good idea to keep up with what is happening in the world of finance. The Financial Times and BBC money pages have provided valuable information for me personally, but there are many others sources of money news.

4 comments