The sooner you understand what lifestyle inflation is and how to prevent it, the more beneficial income increases will be for you.

It does not matter how much money you make – learning to manage your money is the important part.

What is Lifestyle Inflation

Lifestyle inflation is when your expenditure gradually increases overtime as your income increases. This could happen in the short term such as a one-off work bonus or over the long term as your salary increases. Lifestyle inflation is also known as lifestyle creep, as all too often people do not recognise it occurring as income increases and expenditure just ‘creeps’ up on them.

It is important to note that as you progress through life, your expenses could increase – such as mortgage payments, investment contributions or commuting to work, quality of life and expenditure tends to naturally increase as your income increases.

You can prevent lifestyle inflation by following a few simple steps, so read on to find out how you can prevent lifestyle inflation:

How to Prevent Lifestyle Inflation

Budget

A successful budget helps you to monitor where your money goes and keep you on track and on top of your expenditure. Having a budget and sticking to it is one of the best methods to prevent lifestyle inflation.

There are many methods to budget your money – find the best one that suits you. Examples of common budgeting methods are the zero based budget and 50/30/20 split. Decide what you will do with the additional income and how this will fit in with your budget. For example – could you put more aside to pay of any debt you may have, increase your investment amount or save more into a house deposit fund pot.

Track Your Expenditure

Tracking exactly where your money goes and categorising it will help you to understand where you are spending and potentially overspending.

This activity should allow you to monitor your expenditure overtime, ideally your expenditure should stay level overtime as your income increases.

Set Goals

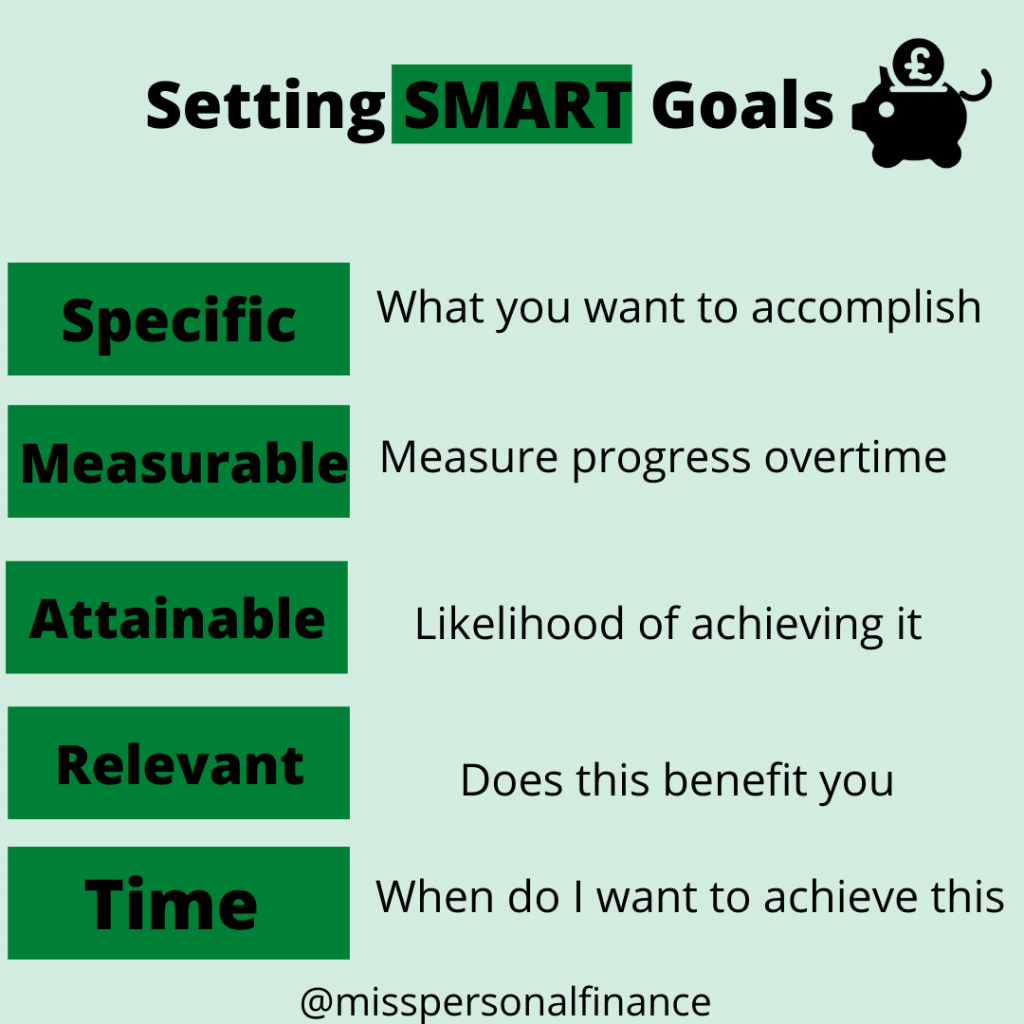

Without any clear, SMART goals set out, it will lead you to spending your money without much care nor acknowledgement for where you want your money to go, in short – goals will help to keep you focussed. If you are unsure on what SMART goals are, check out my Instagram post here.

When you receive a pay rise or bonus your goals will allow you to understand where to put your additional money – such as towards a house deposit, holiday fund or to pay off any debt. You are less likely to fall into the lifestyle inflation trap if you set clear goals and stick to them

Create and Maintain an Emergency Fund

If you do not have an emergency fund set up right now – PLEASE set one up.

It is an easily accessible pot of money that will cover 3-4 months of expenses or any unexpected expenses. Whether or not you have received any additional income, an emergency fund is vital to have. You could save your additional income into an emergency fund, or to top it up if you ever need to use it.

Stop Impressing Others

Do you really need to buy the latest phone or handbag?

Sounds harsh right, but showing off your latest purchases on Instagram will not be beneficial to future you and this is one of the main cause of lifestyle inflation. Continuing to only impress other will keep you trapped in the negative lifestyle inflation trap, the sooner you realise that you do not need to impress others – you will see that your money will be able to stretch further.

Adding additional luxuries to your lifestyle may make you happy in the short term, but in the long run can derail your long-term goals. Personally, I highly value experiences over things…

Enjoy Yourself

Set aside a percentage of your income for ‘fun’ – as your income increases it is important to maintain this figure, rather than increase it, to reduce lifestyle inflation. Life is there to be lived and enjoyed whilst you are able too. Keep a savings pot or set up an account for ‘fun money’ to save up for a holiday or tickets for an event, rather than going into debt to pay for it.

Short-term, memorable events are fun, but make sure they do not limit you obtaining your long-term goals. Find a balance between reaching your financial goals alongside enjoying your lifestyle.

One comment