Opening my Lifetime ISA (LISA) was something I wish I did sooner, however I am glad that I eventually opened one.

What is a Lifetime ISA?

Lifetime ISA’s were launched in 2017. If you are aged between 18 – 40 you can open a LISA and put away a maximum of £4,000 per tax year. The government provides you a 25% bonus on your contributions, so if you pay in the annual maximum of £4,000, the government will put in a total of £1,000! For the Nutmeg LISA, the bonus is paid at the end of each month.

There are two ways to use your LISA :

- Buying your first home (worth up to £450,000)

- When you reach 60 (essentially a retirement fund)

Nutmeg Lifetime ISA

Positives

- It provides a great alternative to the cash only Help to Buy ISA (which has since closed to new applicants). I personally know a few people whom have transferred their H2B ISA into a LISA.

- Provides the options to either put your money into cash or investments (stocks and shares). However Nutmeg currently only provided an investment option – which I personally believe is the better option for long term LISA users.

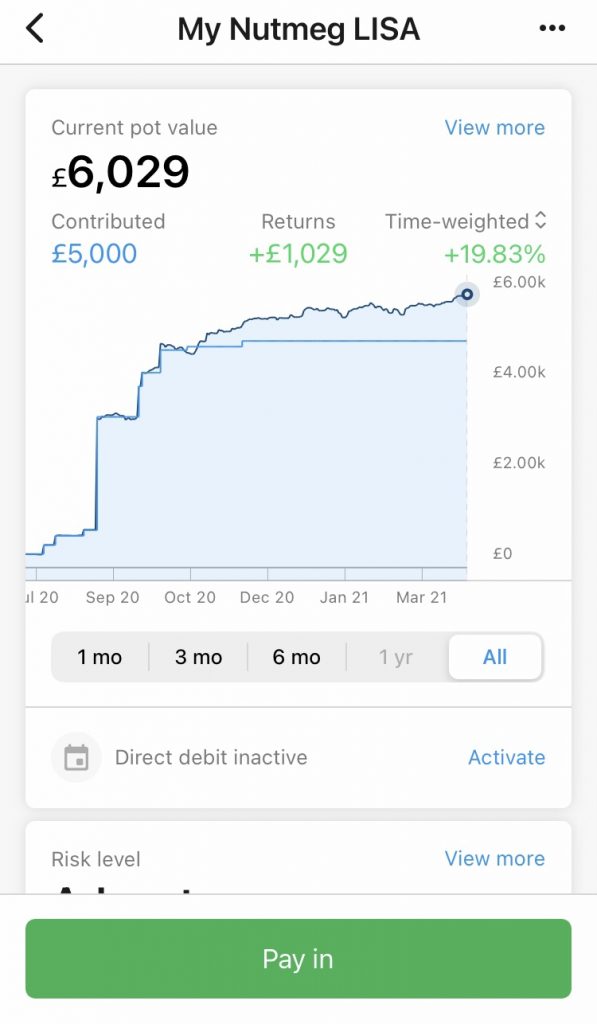

- A Nutmeg LISA is incredibly easy to set up and I have found it simple to use and as it is a robo-advisor, I do not have to decide the funds where my money goes – just decide my risk level and investment style.

- Nutmeg is incredibly transparent and the app shows exactly where your money is being invested – the funds, countries, sectors and also the social responsibility score! It also shows the projected value of your LISA when you reach 60.

- Nutmeg provides a choice of 3 portfolios for you to hold your LISA in – fully managed, fixed allocation and socially responsible fully managed. Each have varying fund costs and Nutmeg fees, so make sure you are aware of the associated costs.

Negatives

- If you withdrawal your money for a reason other than house deposit or retirement, there is a 25% fine – so make sure you are happy to put this money away (the 25% “fine” essentially removes the government bonus)

- If you decide to relocate abroad a LISA may not be the best option for you, due to the withdrawal fees. Moreover, you can only pay into your LISA if you are a UK resident.

- You will be required to pay fees to cover management of your funds, however I do not think that there is a fee-free LISA currently available.

- You will need to have your paid into you for at least 12 months before purchasing your first home

- The government bonus is only paid until you reach 50

- Aside from Nutmeg, there are other providers available – such as Moneybox, Hargreaves Lansdown and AJ Bell – with AJ Bell having a low annual charge, but minimum investments of £500.

How to Open a Nutmeg Lifetime ISA

Nutmeg has a recently improved its referral programme. If you sign up for a LISA using this link & pay in £500 you will not pay any management fees for 6 months! They have an app as well as a website to login and pay in to your LISA and check up on it which are both clear to use and easy to navigate.

It is incredibly simple to open and you will be asked your investment style and risk – do not worry if you are not sure on these during opening your account as you can always change these whenever you like. A simple questionnaire will provide you information of what risk profile your investments will be in, if you are unhappy with the risk profile you can retake the questionnaire.

Got any questions? Post them in the comments below, or contact me via my Instagram

4 comments