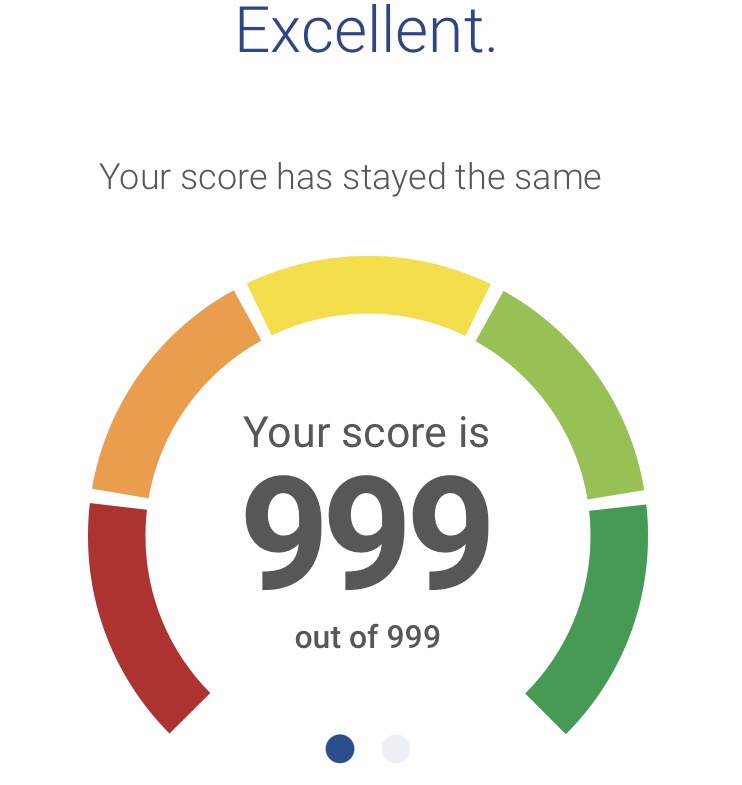

My tips on how to score an excellent credit score. I currently hold a score of 999 and working on retaining it in the long term.

What is a credit score

A 3 digit number that represents the likelihood of you paying your bills and borrowed money on time. The higher the number indicates that you are able to pay your credit back on time, which will make you more attractive to a potential lender.

Lets not get this confused with your credit report which is a more in-depth insight on your credit history. It provides detail such as debt totals, how quickly you pay off your debt and if you take on more debt to repay existing debt.

Why is a credit score important

Whenever you want to apply for credit (such as a credit card, loan or mortgage) the lender will take a look at your credit score to determine whether or not to lend you their money. The better your credit score, the higher the chances of you being approved on what you require.

As well as the ability to be approved for loans a good credit score will also allow you to be accepted for better rewarding credit cards such as those with better interest rates or with rewards such as cashback or travel points. Often landlords will check your credit score before accepting tenants to stay at their property, therefore a better credit score will provide you the opportunity to rent a wider choice of properties. Even when applying for a SIM card with a new provider they will check your credit score to see if you will make your payment on time.

How to increase you credit score

Not all lenders have the same criteria to work out your credit score, so one lender may accept you whilst you may be rejected by another. However, I have found that there are a few overriding similar factors:

- Register to vote on the electoral role. This allows lenders to identify the address that you live at and could potentially increase your credit score by 50 points. If you have not yet registered to vote yet, follow this link to register onto the electoral role.

- Clear your credit card in full every month – ensure that you pay more the minimum required every month. This appeals to lenders as they assume that you can pay off debt quickly.

- Pay your bills on time. Lenders want to be assured that you will be able to pay their money back on time with minimal / no delays and showing that you have history of paying back bills on time will help to prove this. Even paying back your phone contract, rent or Netflix bill on time continuously will be of benefit. Payment history plays a large weighting in determining your credit score.

- Credit limit of at least £5000. This is the amount of money your credit cards allow you to borrow. Having a credit credit of at least £5000 will be a positive for your credit score.

- Not applying for credit often. If you keep your new applications to a minimum such as applying for a new credit card, could increase your score. No new applications for at least 6 months should be your aim.

How I maintain an excellent credit score

There are a few things I do to ensure my credit score remains in the ‘excellent’ category:

- Keep my credit utilisation to a minimum – mine is usually around 20%, mainly thanks to fairly big credit limits that my credit card providers have stated are suitable for me. I have recently received an email from Clear Score stating that my low credit usage is providing a positive impact on my score

- As I wrote about in this article regarding how I make my credit cards work for me, I believe using a credit card sensibly and paying it off full every month with a direct debit benefits credit scores.

- I keep track of my credit score every month. At the beginning of the month, when credit scores are updated I will get an email into my mailbox which will prompt me to check my credit score. This allows me to keep on track of the score and act upon any changes

- Keeping my credit score high is as important as staying out of debt, investing as much as I can and not spending more than I can afford.

- However I have always and will always take credit scores with a pinch of salt as I do believe they are not a true representation of someone’s cash flow or credit usage.

One comment